Will you have a lower-than-expected income in 2021? Would taking withdrawals from an IRA in 2021 be a good idea if I expect my income to be lower than usual? Let’s dive in.

You generally must start taking withdrawals from your IRA, SEP-IRA, SIMPLE IRA, or retirement plan account when you reach age 72 (70 ½ if you reach 70 ½ before January 1, 2020). Roth IRAs do not require withdrawals until after the death of the owner. You can withdraw more than the minimum required amount.

So, wait or take withdrawals this year even if you don’t have to or even need it? There are a few things to consider.

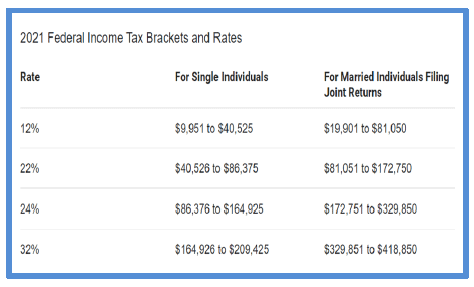

First, how much can I withdraw without moving into a higher tax bracket?

As you can see, it’s not that simple a question.

Have more questions about what would be a strategy for your specific situation? Just give the office a call. We never charge a fee to get you the information you need to make a sound financial decision.

Cheers!