What will the new year bring? Will the stock market soar? Will it be flat? Will it decline?

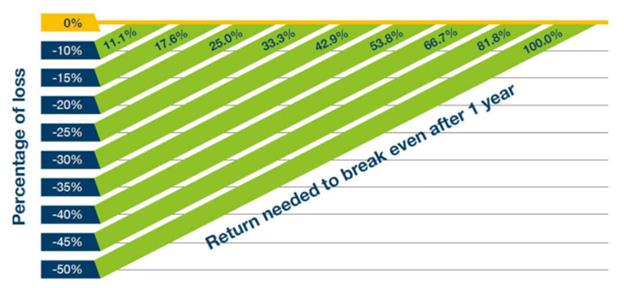

As we continue to experience high levels of volatility in the markets due to several factors, I think it’s important that folks understand what it takes to recover from a downturn in the market. What is the Break-Even Point? It’s essentially the return that you’ll need to recover from a downturn in the market.

Example – If you experienced a 20% decline in your account, it does not require just a 20% upswing to recover. It requires a 25% return. A 35% decline requires a 53.8% just to get back to even. A 50% decline will require a 100% return just to get to even. One bad year can wreak havoc on an investment portfolio and the required return just to break even could be significant and take a long time to recoup. The time our clients do not have. That is why we always have about half of our client’s assets in 100% insured and guaranteed positions. The other half we position in a well-balanced actively managed portfolio of nimble, easily repositionable investments

It’s time to be Safeguarding & De-risking assets by providing that downside protection. As they like to say ZERO is your hero!