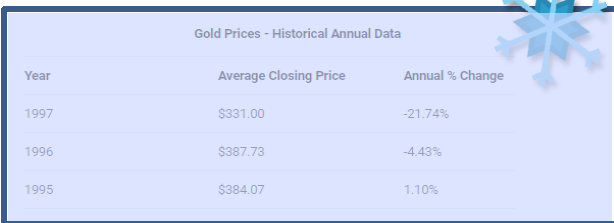

It’s OK to like shiny things but are they good invest- ments? You can invest in gold and silver by buying the actual physical products, or, through ETFs and stock in gold mines or mutual funds. But, I keep seeing commercials on TV; Mr. So ‘n So thinks it’s a great idea and can’t lose. He’s an actor, so I’m sure he knows a lot about investing. He makes gold sound like a ‘can’t lose’ proposition. Not so much!

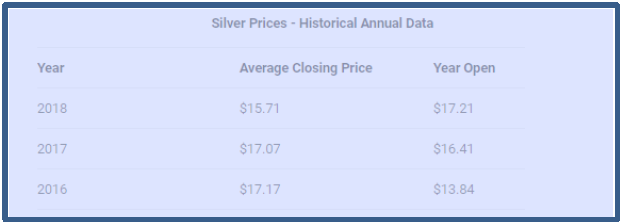

How about silver? The commercial also seems to think that’s a ‘can’t lose’.

How are they getting away with this deceit? Buying gold is the oldest type of investing. The reason why gold cannot be an investment, is because it belongs to a class of investments that will never produce anything. Growth in its value depends entirely on the belief that someone else will eventually pay more for it. Gold is an unproductive asset. A pile of gold will always be just that, a pile of gold. An equivelent amount of money deployed into a business can generate actual wealth and grow larger in a fundamental way. The value of gold has always been driven by the fear that other assets will lose value.

Does this mean that nobody should invest in gold or other precious metals? No. Not necessarily. It can have a place in a diversified portfolio, but understand, it’s not all that the commercials make it out to be and it’s not a sure thing.