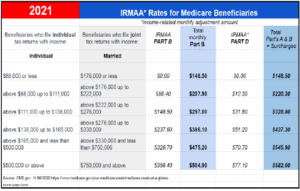

Hi all! As a follow up to last month’s article, here I will give you some additional information. And I’ll let you know how and if taking more income could affect your Medicare premium.

Several tax cut provisions, especially income tax cuts, will expire in 2025, and starting in 2021 will increase over time; this, by 2027 would affect an estimated 65% of the population and in that same year the law’s provisions, for personal, not corporate, are set to be fully enacted.

Why do they expire, you ask? Well, that’s the only way that the prior administration was able to meet budget rules. The Biden administration recently has said that they will absolutely let them expire. Interesting, because Biden suggested a future Congress won’t let middle class tax cuts expire. Recent precedents, like the often-extended Bush tax cuts. Still, there’s zero guarantee of that. After all, a lot can change over eight years.

1. Will the extra income cause my SS income to be taxed if you’ve started taking it? Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

2. Will this administration change the 2021 tax rules, mid-year (retroactively), like Bill Clinton did? I remember exactly where I was when I heard that news. I almost drove off the road, yelling “he can’t do that!” But he did.

So, as you can see, it’s not that simple a question. There’s a lot to think about. Please understand that this is not a critique of this or any other administration. This is just a factual article about a choice, or a possible dilemma, that our clients have at this moment in time. It has nothing to do with

politics and everything to do with looking at the past and present to try to decide what the best move might be for YOU specifically.

If you would like to discuss this or any other financial questions with one of our expert advisors, please don’t hesitate to give the office a call. Remember, never a charge.