American Retirement Advisors Turns Healthcare Decision Making Right Side Up!

By David S. Edge and David P. Schaeffer, American Retirement Advisors

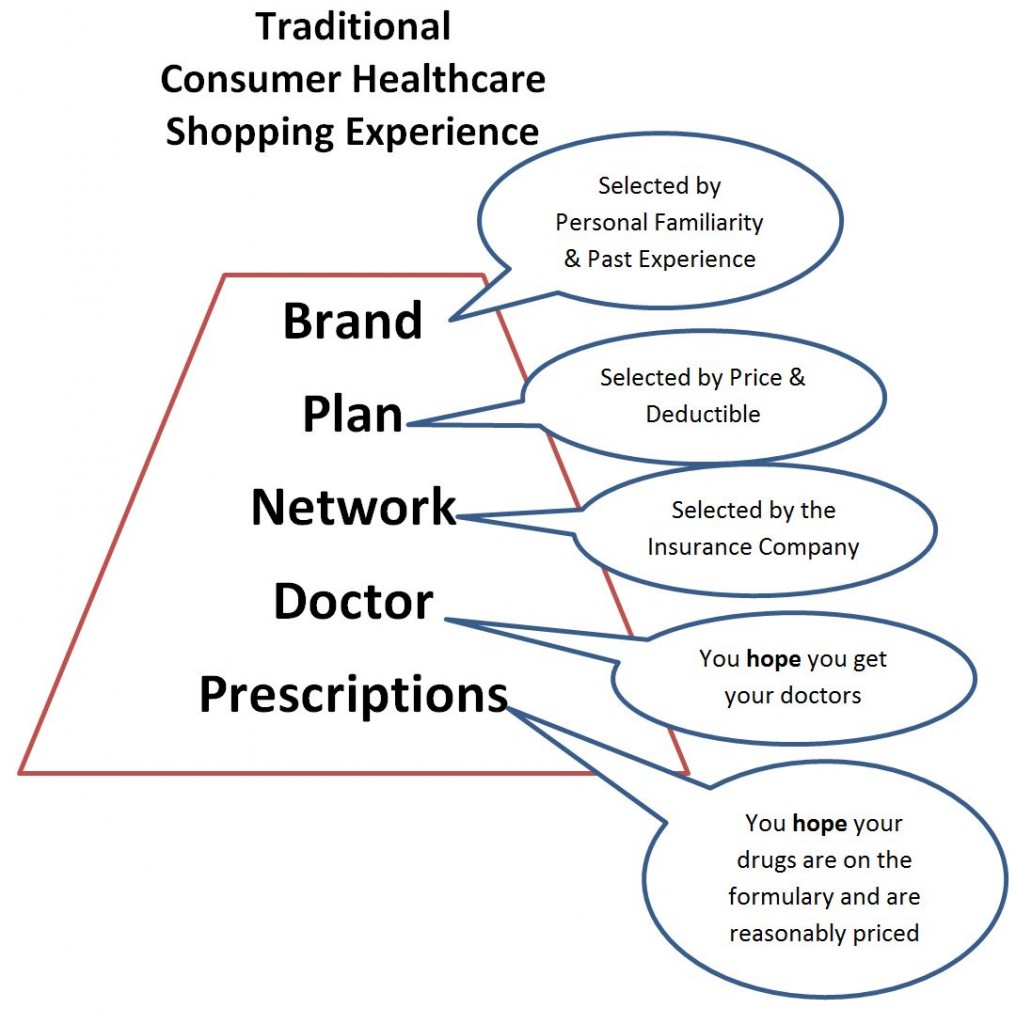

When choosing healthcare most folks choose a brand they are familiar with from their previous employment or personal experience from prior years. You have become “Brand Loyal” because the plan you had worked for you and you were satisfied. You liked your doctor, labs and specialist and the co-pays for Drugs weren’t all that expensive. Now you have to pick a Healthcare plan to start over and where do most shoppers go? To the Brand they know! So you pick a Brand you’re familiar with, a Plan, Network, and hope they have good Physician and prescription co-pays. What you’re selecting based on this process is “I hope so” healthcare when it should be “I Know So” healthcare. Instead of having a warm fuzzy for a brand you’ve used in the past, what you need to be doing is hard research for a “Fact Based Decision”. Most Employer plans are a version of what a Brand has to offer based on what the employer wants to pay for employee healthcare. This is why two employer plans can have the same name brand but the plans co-pays will be much different.

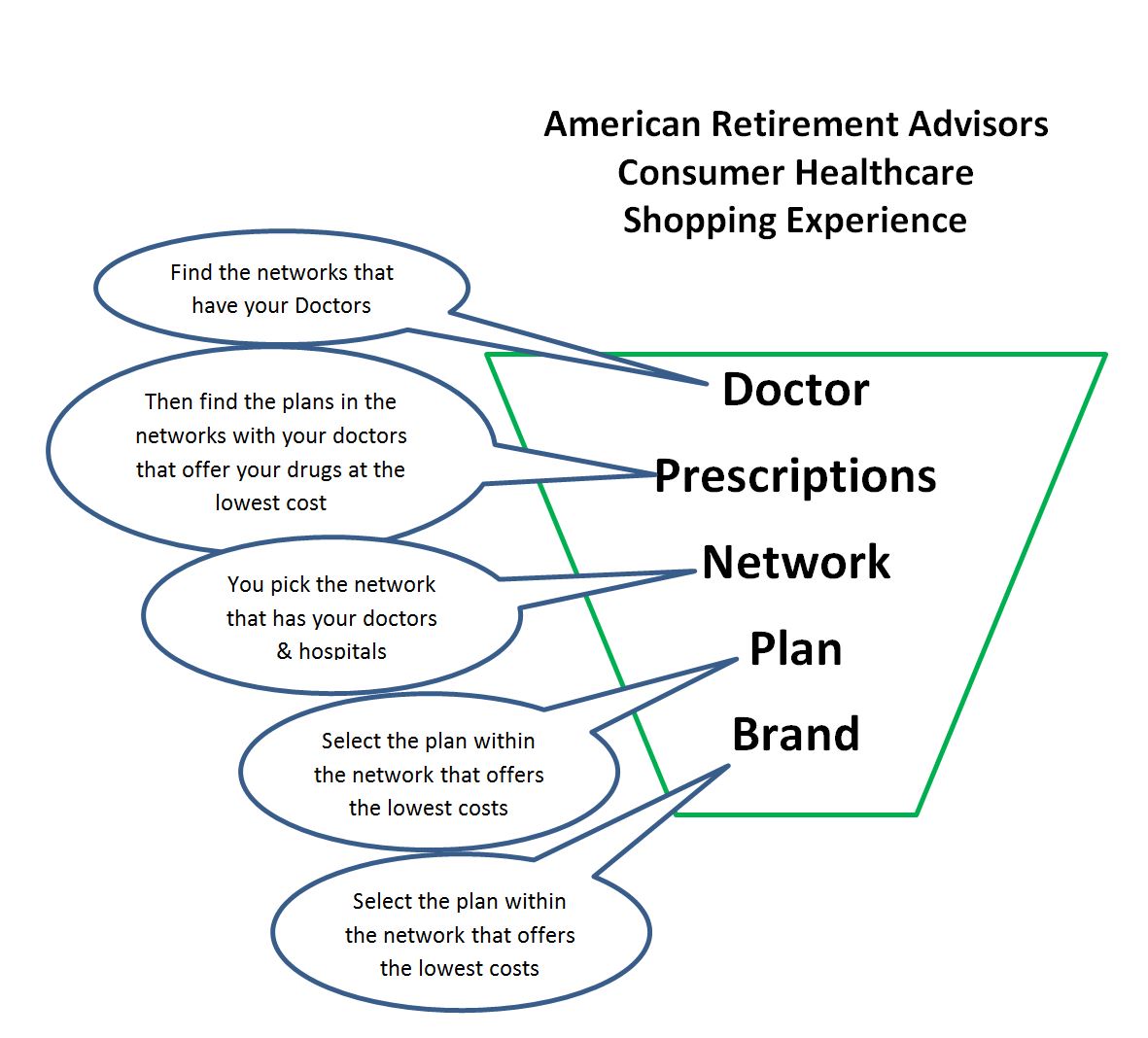

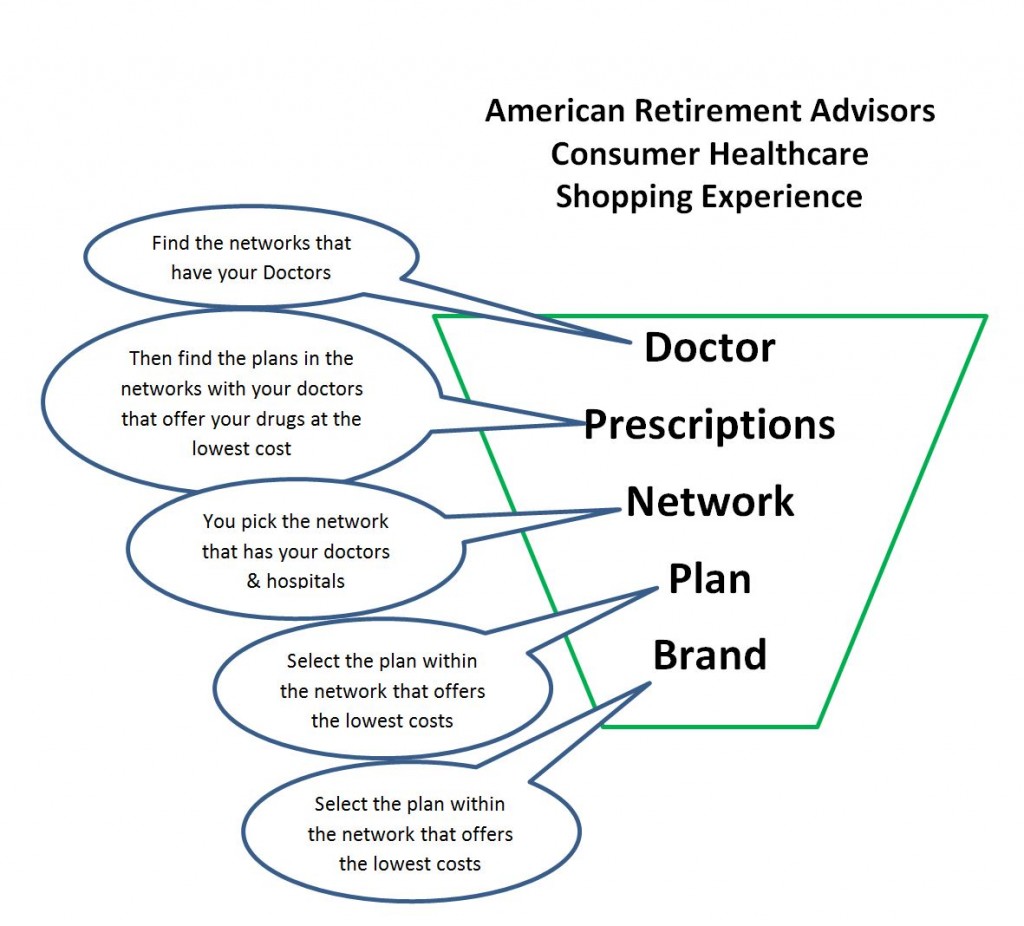

By using the American Retirement Advisors method you start your search with your Doctor’s and Hospital you want to keep and use. Then as you narrow your search to the handful of networks and plans your Doctor and Hospital are participating with, lay in your prescription drug needs and discover exactly what your co-pays will be on those plans. As you narrow your choices to a plan then look for the “Brand” of that specific plan. As you narrow your search from dozens of plans to the 2 or 3 that have your Doctor, Hospital and Drugs on their formulary, you’ll have other things to consider. Many times these items to consider will be costs associated with co-pays and deductibles on Doctor and Specialist visits, labs, diagnostics, X-Rays, and other medical services. These costs should also include a monthly premium if any, and a Maximum out of pocket dollar amount which would be the maximum total of co-pays you would be responsible for paying in an entire calendar year.