Gotta love the market

September 2017By David P Scheaffer

Up, Up, and Away (like TWA). Well, we all know what happened to TWA. It was great while it lasted! Most of our clients are nearing or in retirement. That usually means folks rely heavily on their savings for retirement. Wouldn’t it be great if we could all ride the UPs of the market and have a safety net if the market corrects?

[spacer height=”03px”]

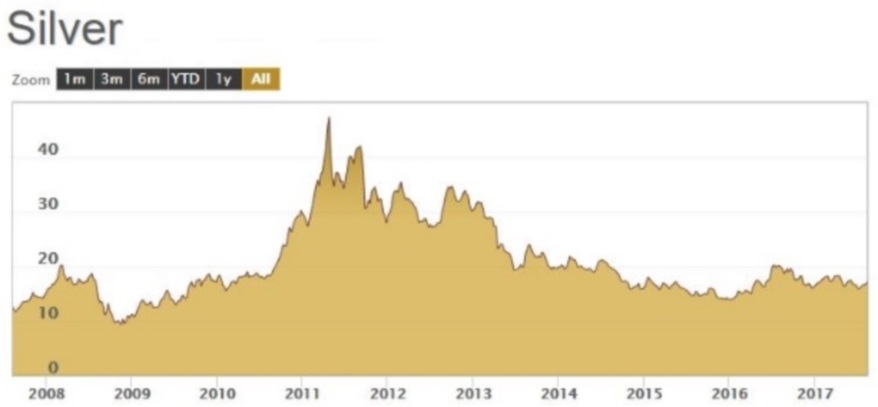

I’m not suggesting you run for the hills and put your savings into the mattress or heavy metals. Perhaps a mixed approach may be a good alternative to 100% of your savings exposed to the market. I like shiny metals.

If you visit our office, stop by, I keep a few bars around for fun. I’m not suggesting you buy them because they experience markets ups and downs as well.

[spacer height=”03px”]

[spacer height=”03px”]

When was the last time you had a Certified Financial Planner (CFP®) review your port-folio and provide a comprehensive overview of your life-long savings. The question was rhetorical, most folks have never met a CFP. My point… it’s your money!

[spacer height=”03px”]

While the market is at an all-time high, stop to smell the roses. Take a look at carving off some of those gains and make sure you are protected from a market correction. (I hope you are making money in this market.) The last 3 times the market corrected it took over a decade for the recovery to get market values back to the same spot. Do you have 10 years to wait if the market drops again?

[spacer height=”03px”]

The folks at the bank, credit union, and large brokerage firms are all nice people. They are doing the best they can with what they must work with. Their portfolios and choices are preselected to make sure the firm is protected against law suits. The offerings are vast in scope, but similar in that they mostly fluctuate to the market’s whims. Oh yeah, they also must make the firm residual income. While there is nothing wrong with making a living…

[spacer height=”03px”]

What if what they are doing is not meeting your financial needs? What if the market drops 30%? What happens to your retirement income? My guess is it will drop as well, or you will need to dip into your principal to make ends meet. What happens next? Will you run out of money? It happened to millions of folks in the last market correction in 2007. Those retirees had to go back to work or, worse, sell their homes and move in with their kids.

[spacer height=”03px”]

It doesn’t have to be that way. Hundreds of our clients weathered the last BIG financial storms with little or no change to their retirement income. We reveal how we do what we do. We keep no secrets. In fact, we share how we make decisions in your best interest, as well as how and what we get paid in the process. Did I mention we made our clients money in the last market correction?