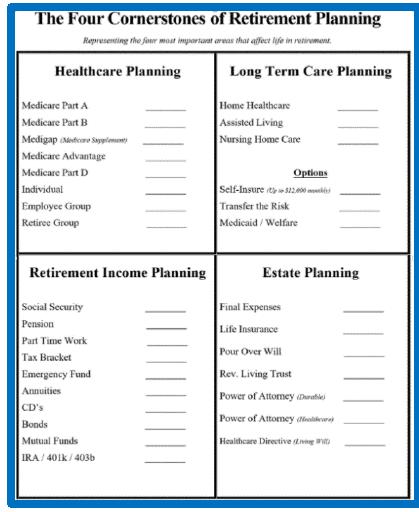

Welcome to October. This month I thought I would go back to the core of what we all do here at American Retirement Advisors. Our firm is holistic in nature, which means that we help with the entirety of retirement planning. Not just insurance, or just Social Security, or just assets and income planning. The entire package. Let me explain our 4 Cornerstone process.

(Remember, if you only have three legs on a four legged chair, you’re going to fall.) We start with a foundation of health Nothing else matters if you’re not taking care of your health. So, first, we decide on healthcare coverage that fits your budget and lifestyle either group insurance from work or Medicare with a Supplement or an Advantage plan. As most of you know, we favor no one company or plan and present all available in your area.

Now, Long Term Care (LTC) planning is an insurance and financial hybrid for your holistic plan. On the one hand, it may be a health necessity. On the other, it can certainly drain your accounts quickly if it pays for a long term care facility, assisted living facility, or home health care. Of course, if you qualify f or Medicaid (qualifications differ by state), you won’t need a LTC policy. But if your assets disqualify you for Medicaid for long term care, there are financial strategies that we may be able to deploy to help. *NOTE* You must set up these strategies before needing the care.

Retirement Income planning sets up the overall way you will live covering reoccurring bills for housing, utilities, food, and the like making sure that you can have the extras you want and not run out of money. We answer questions like: Should I pay off my house and cars? How much should I leave in the bank? Should I take my Social Security income early or wait? We build comprehensive retirement income plans and do not charge anything for the process because the planning is that important.

And finally, Estate planning . Whether you’re of modest means or a Rockefeller, you need a plan. Are your wishes in writing? Do you need a will, a trust, a Power of Attorney, a living trust? Who gets your money who gets your s tuff when you die? Your house and cars? Your dog!? What if you don’t die, but you can’t care for yourself or speak for yourself? Who takes care of you, and does that individual know? Not fun to think about, but you need to. It’s all part of our complimentary planning process.