Click the icons below to view or download our research on Savings programs

Try our simple savings calculator today!

The concepts of savings

Interest Rates:

Interest Rates:Interest rate is the primary component in the concept of savings. Interest rate is defined as the opportunity cost of holding money in hands, i.e., the amount foregone for keeping the money in hand. It is the incentive that propels any person to deposit money in banks.

There is a great deal of controversy regarding the effectiveness of interest rate on savings and investment. Classical economists believe that interest rates largely determine the volume of savings-investment for an economy. On the other hand, Keynesian economists advocate the dependency of savings rate and investment on money supply-demand mechanisms.

Types of savings plans

Overview of Savings Account

The savings accounts are those that provide the holders of these accounts a certain interest as a form of payment. The savings accounts are normally used as a holding account for instant access to cash in an emergency.

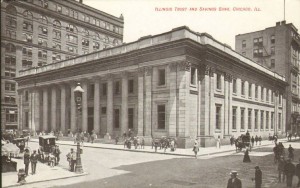

Providers of Savings Accounts

Financial institutions are offering a number of savings accounts and some other related services. These institutions include the following:

Commercial Banks

Credit Unions

Savings Associations

Mutual Savings Banks

Loan Associations

Insurance Companies

Savings Accounts

The biggest advantage of the savings accounts is that the people can save a certain amount of money. This money can be used later in order to buy assets that provide these account holders with greater financial returns or in case of emergency.

Savings Account Features:

Most savings accounts provides a monthly, quarterly or annual bank statement. These documents give well-detailed lists of all the transactions that have been executed by the holder against the particular account.

The funds have to be kept for a minimum possible amount of time. Many financial organizations that offer savings account services also provide money market accounts and demand accounts that allow the holders to issue checks against these accounts. A majority of the savings accounts provide the holders with limited access.

Online Savings Accounts

The services of the online savings accounts typically offer rates many times greater than found in traditional banks. The introduction of the World Wide Web has actually helped in bringing down the costs of service to be paid by the account holders.

The services of the online savings accounts typically offer rates many times greater than found in traditional banks. The introduction of the World Wide Web has actually helped in bringing down the costs of service to be paid by the account holders.

As a result of the excellent returns provided by the online savings accounts. Many savings accounts provided offline have been forced to increase the rates of interest that are being provided by them.

Click below to view or download our research on Investments

The concept of investing

Investing is similar to lending with one key difference, no recourse for loss of initial capital. When investing you are risking your capital in exchange for some form of ownership in the entity in which you give your capital. The stock markets were built on this exchange. The noun “security” comes from the certificate that is provided as proof of ownership in the entity. The challenge with it is there is no “security”. The term “security” was coined to provide the investor of the perception of a safe and secure transaction.

Investing is similar to lending with one key difference, no recourse for loss of initial capital. When investing you are risking your capital in exchange for some form of ownership in the entity in which you give your capital. The stock markets were built on this exchange. The noun “security” comes from the certificate that is provided as proof of ownership in the entity. The challenge with it is there is no “security”. The term “security” was coined to provide the investor of the perception of a safe and secure transaction.

Savings, as contracted to investing, has little or no risk to your capital. Still, both require you transfer your assets to another entity. Savings typically are insured and provide guarantees against loss of principal and offer a guaranteed interest rate.

The term “blue chips” refers to the old largely capitalized, highly stable American companies that have been the bedrock of our economy for many years. Today they could include; Apple, General Electric, IBM, Microsoft and others. In reality the term “Blue chips” was coined by the color of the highest value poker chip in 1904. Investing is similar to gambling in that you are betting on a future outcome within a set of rules that are supposed to be designed for fair play for both parties.

Types of investments

The Three Types of Investments, as the dictionary.com defines; is something that is purchased with money that is expected to produce income or profit. Investments can be broken into three basic groups: ownership, lending and cash equivalents.

Ownership Investments:

Ownership investments are the most volatile and profitable class of investment. They include:

- Stocks; Stocks are certificates that say you own a portion of a company. Actually, all traded securities, from futures to currency swaps, are ownership investments even though all you may own is a contract. When you buy one of these investments you have a right to a portion of a company’s value.

- Business; The money put into starting and running a business is an investment. Entrepreneurship is one of the hardest investments to make because it requires more than just money.

- Real Estate; Commercial property, Houses, apartments or other dwellings that you buy to rent or repair and resell are investments.

- Precious Objects; Copper, Gold, Silver, Platinum, original artwork and a autographed memorabilia can all be considered an ownership investment – provided that these are objects that are bought with the intention of reselling them for a profit.

Lending Investments:

Lending Investments:

- Lending investments (Bonds) tend to be lower risk than many other ownership investments and return less as a result. A bond issued by a company will pay a set amount over a certain period. Bonds are loans to companies, and governments. These are sometimes referred to as debt instruments. Bond is term used for a wide variety of debt investments from CD’s and Treasuries to corporate junk bonds and international debt issues. The risks and returns vary widely between the different types of bonds, but on the whole, lending investments pose a lower risk, and provide a lower return, than ownership investments.

Cash Equivalents:

These are investments that are “as good as cash”, which means they’re easy to convert back into cash. Sometimes referred to as demand accounts.

- Money Market Funds; With money market funds, the return is minimal, as are the risks associated. Money market funds are designed to be liquid offering the ability to write checks similar to a checking account.

- Your Savings Account; Even if you have nothing but a regular savings account, you can call yourself an investor (really you’re a “saver”). You are essentially lending money to the bank, which it will dole out in the form of loans. The return is pitiful, but the risk is also next to nil because of the Federal Deposit Insurance Corporation (FDIC).

Investment Strategies

“A strategy is not pick a mutual fund from a list, pay a broker or online trading firm a fee and your done!”

“A strategy is not pick a mutual fund from a list, pay a broker or online trading firm a fee and your done!”

Our firm specializes in investment planning involving two different goals;

- Investment for Retirement Income

- Investment for Retirement Savings